Masks, Olympics + Business Boost Grants…

….we’re excited about two of the three recent announcements for QLD.

But mostly the $15,000 Small Business Grant that is opening at the end of this month!

Queensland small businesses are being urged to get ready to apply for the new Business Boost grants to help fast-track their plans to improve their efficiency and productivity.

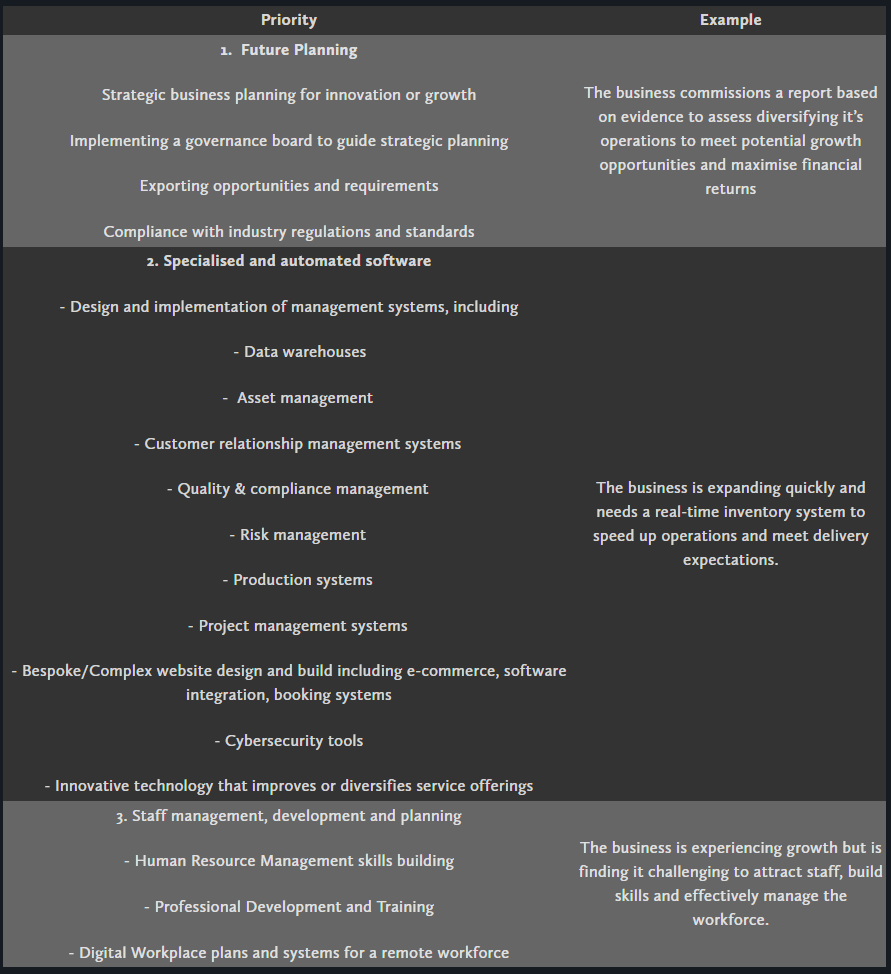

This support includes funded activities in 3 project areas:

Future planning

Specialised and automated software

Staff management, development and planning

The grants can be used for activities such as website development and upgrades, strategic marketing, training and coaching, advisory services and planning for business continuity and succession.

Eligibility Criteria

To get your hands on this little gem, your business must (at the time of applying):

have fewer than 20 employees;

have an active Australian Business Number (ABN) and registered for GST;

have a Queensland headquarters;

have a turnover of between $300,000 (minimum) and $600,000 (maximum) in the last financial year (2020–21)

have a publicly reachable web presence to identify business operations (e.g. business website and/or social media pages)

not be insolvent or have owners/directors that are an undischarged bankrupt.

Available Funding

The applicant may be eligible to receive a grant payment up to $15,000 (excluding GST) on completing the proposed project.

Successful applicants must co-contribute at least 30% of the total project costs.

Grant funding will be paid only after compliant acquittal documentation is received.

The grant will not fund projects with:

a total cost of less than $10,715 (excluding GST), or

payments made before the approval date (you must be approved before you pay for grant-funded project activities).

Good Projects

Some examples of eligible project activities are shown below.

DESBT will fund the following eligible project activities:

The above list of eligible projects activities is not exhaustive. DESBT will consider similarly scoped project activities.

Bad Projects

Some examples of ineligible project activities are shown below.

DESBT will not fund the following project activities:

Activities bought using crypto-currencies, barter, or services in-kind

General business operating costs (e.g., bookkeeping/accounting, tax returns)

Real estate/property, hire, lease, or rental fees

Goods, services, or fees from related parties

Travel

Franchise fees

Purchase of stock

GST, registration and fees

Maintenance of existing digital technologies

Computer hardware (e.g., computer servers, PCs, tablets\iPad, mobile phones)

Activities purchased via direct selling (e.g., by party plan or network marketing)

Delivery, credit card and transaction fees

Memberships and joining fees

Salaries

Fleet vehicles

Website hosting

Stand-alone marketing, advertising or campaign delivery costs (e.g. Google AdWords, Facebook advertising or similar expenses)

Applications:

On your masks, get set…. History tells us this grant will be a tightly contested affair. The last grant announced closed within 3 hours of opening.

Make sure your application is prepared BEFORE the opening of applications at https://www.business.qld.gov.au/business-boost at 9am on 30 July 2021.

This grant is a beauty … lets stand on the podium with some forward thinking + organisation.

Stay safe. Shake tax, not hands!

Get in touch with m+h Private tax specialists today on +61 3036 7174 if you need support for you and your business.

As always, the above is general in nature, and the details may change, please discuss with your trusted advisor.