$50,000 Business Growth Fund Program

Whilst ScoMo is dealing with Albo, here’s the downlow…

The Business Growth Fund Program has now launched Round 4 with Stage 1: Expressions of interest opening on 31 May 2022.

Much like the current political circus, there are a few hoops to jump through with a 3-stage application process before assessment. We’ve tried to make it as clear as Albo’s policies so that you’ll be ready to submit expressions of interest as soon as they open.

Applications will close faster than the new governments books on election day so get in quick!

What is the BGF?

A single, upfront payment for eligible Queensland businesses to buy specialised equipment to support business growth, increase production, expand workforces and maximise economic returns.

Funded businesses are expected to:

increase confidence for growth, transitioning from small to medium-sized

increase productivity, turnover, profit and employment by 20%

improve confidence to automate, scale up, increase market share, diversify and/or exploit exporting opportunities.

Available funding:

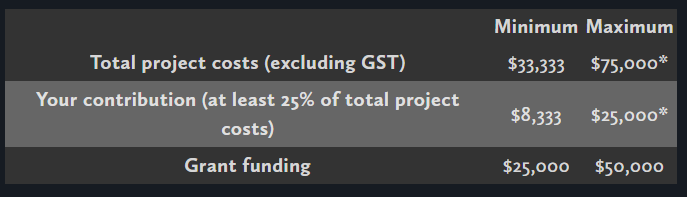

Small-medium businesses may be eligible for up to $50,000 (excluding GST), and not less than $25,000 (excluding GST).

Successful applicants must co-contribute at least 25% of project costs.

The table below show the breakdown of total project costs and the co-contribution amounts.

*Projects can cost more than $75,000 but the maximum amount DESBT will contribute is $50,000.

Projects with the following will not be funded:

a total cost of less than $33,333 (excluding GST) or

payments made before the approval date (you must be approved before you pay for grant-funded project activities).

Funding must be used to buy specialised equipment to meet business growth. The equipment must have a direct link to increasing employment and maximising economic returns.

Examples of eligible highly-specialised equipment include (but are not limited to):

production equipment to meet otherwise unachievable growth demand

advanced manufacturing or digital equipment and systems

advanced logistics systems and equipment

Eligibility criteria

You must be an established small to medium-sized Queensland business who is financially sound and have the potential for high-growth within the next 2 years.

High-growth is defined as a 20% increase in productivity, turnover, profit and/or employment in the last 12 months.

To be eligible for this grant, your business must:

have a minimum trading history of 3 years at the time of application

have a minimum turnover of $500,000 for the last financial year

have fewer than 50 employees at the time of applying for the grant

have an Australian Business Number (ABN) and be registered for GST

For a full list of ineligible activities and eligibility criteria, refer to the grant guide. You can also use this eligibility criteria tool to check if you are eligible.

Application Stage 1: Expression of interest

From 9am on 31 May 2022, you will be able to submit your Expression of Interest (EOI) application. In this you will be asked to:

confirm the business meets the eligibility criteria of the grant program

provide a description of your business and a copy of your business's current business plan

provide a letter from a Certified Practising Accountant (CPA) or Chartered Accountants Australia and New Zealand (CA ANZ) declaring projected business figures, turnover and employee count for the 2021–22 financial year

provide a description of the proposed specialised equipment and clearly outline how the purchase and implementation of the equipment will assist the business to reach its high-growth and employment plans (Note: Supplier quotes are not required at this stage)

confirm the business's financial contribution

declare the project is not part of the everyday operations of the business.

EOIs are assessed competitively. You will be notified if you have been shortlisted to progress to Stage 2: Full application.

Applicants that are short listed will be notified to progress to Stage 2: Full application which requires documents including, business plan, financials etc. Following this, further shortlisted applicants will be invited to Stage 3: Pitch to business experts and DESBT executives to present a succinct and compelling pitch of 5 to 10 minutes.

And there you have a simple breakdown of the grant as promised……

Get in touch with m+h Private tax specialists today on +61 3036 7174 if you need support for you and your business.

As always, the above is general in nature, and the details may change, please discuss with your trusted advisor.